Legal Expenses Market in India

The

demand for legal services exists in times of adversity as well as growth, as is

evident from the Covid-19 situation. Even before 2021, legal costs in India

were rising with each passing year but dipped in FY 2021 which was still 12.42%

higher than FY 2019. Market difficulties, regulatory responses, stimulus programmes,

changes in employment, and other stressors provide potential sources of demand

for legal services.

India

has acquired a reputation of an expensive legal system. For perspective,

India’s GDP in 1991 was $266 Billion and is expected to cross $5 Trillion by

2025. Such growth in the economy runs parallel to growing legal complexity. India’s

booming unicorn landscape has been a catalyst for a higher than ever investor

& founder disputes. Debt and equity financing, private equity, mergers and

acquisitions and venture capitalists are some areas that are witnessing

increased commercial cases and arbitrations. This spectacular economic growth

will fuel the Indian market for legal expenses

as well.

According to the Legal

Services Authorities Act, 1987 (Government of India), Legal Service includes

the rendering of any service in the conduct of any case or other legal

proceeding before any court or other authority or tribunal and the giving of

advice on any legal matter.

In

FY 2020, legal expenses rose 9% to 38754 crores. It has been observed that when

the economy doubles, the legal expenses triple. They are forecasted to be over

1 lakh crore by 2025 and 3 lakh crores by 2030. Increased FDI and shifting tax

regimes have also contributed to increasing legal costs. For instance, Amazon

spent Rs 8,546 crore ($1.2 Billion) in legal expenses during 2018-2020 to maintain

its presence in India. Around 20% of Amazon’s revenue was being spent on lawyer

fees. The rise in demand for more sophisticated legal services was followed by

rise in the supply as well. Despite that, the expenses kept soaring.

In

FY2021, the pharmaceutical industry marked the highest legal spending at an

aggregate of nearly Rs. 7595 crores while the telecom industry marked the

highest spike in its legal expenses at a whopping 48.88% YoY change. The pharma

sector was followed by Infotech, banks, finance and capital goods in terms of

highest spenders. Out-of-court settlements are becoming more commonly practiced

as companies try to save both time and money. The total legal spending of all

the listed companies on Indian exchanges may sound big, but it is minuscule at

just 0.47% of their total revenue and 0.59% of total expenditure. However, the

recent trends suggest that this percentage is going to skyrocket later in this

decade.

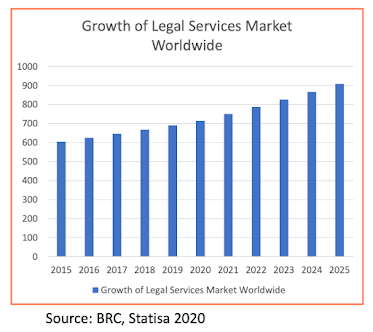

At a global level, In the last decade, the size of the market for legal services has nearly doubled where US companies spent 166% more on legal services than its counterparts. This is due to its complex corporate landscape and varying tax laws and other regulations in different states. Similarly, as India continues to adopt globalization, disputes with respect to finance, corporate restructuring, and governance such as ESG and intellectual property rights will demand that corporates increase their overall legal spending. This would exponentially expand the country’s share in global legal expenses. While the growth of the legal industry portrays a promising story for the country, the harsh reality of the associated expenses being borne by the litigants also needs to be addressed.

The Burden of Legal Costs

“Let

a lawsuit enter a household and rest assured, even the one who wins shall have

lost everything.”

is a saying that has held true throughout generations. Today, fighting a case

in a court of law is even more expensive than a decade ago. On 25th

November National Law Day, the then-president of India Ram Nath Kovid said, “A

relatively poor person cannot reach the doors of justice for a fair hearing

only because of financial or similar constraints while it’s in our

constitutional values and republic ethics. It is a burden on our collective

conscience.” The factors behind litigation costs reaching heights are both

direct and indirect. The courts are currently facing the mammoth task of

clearing up a colossal number of pending cases. The longer previous cases are

pending, the more expensive it becomes to pursue new cases. Some of the other

factors include legal ignorance, improper framing of charges, lack of laws

regulating the fees of professionals and so on. Despite the government

initiatives to make legal battles a level-playing field, the ground reality

remains that lack of funds significantly affects your ability to contest.

As per a survey by DAKSH, 90% of Indian litigants earn less than 3 lakh per annum and the median cost for this group is around Rs.16,000. As per Prashant Bhushan, a renowned public interest lawyer in the Supreme Court of India, 80% of our country is shut out of the judicial system as they cannot access lawyers in the first place and the quality of legal aid available to them is extremely poor. The Supreme Court is well aware of the problem. In Vinod Seth vs Devinder Bajaj, the apex court had observed: “Under no circumstances, costs should be a deterrent to a citizen with a genuine or bona fide claim, or to any person belonging to the weaker sections whose rights have been affected, from approaching the courts.”

Just 1% of the respondents of the DAKSH survey were utilizing free legal services provided to the weaker sections who otherwise can’t afford to pursue a litigation. It’s not just the access to courts which is limited by financial barriers. Lack of funds is also the main reason why individuals do not meet the conditions for bail. While large conglomerates are building in-house capabilities by hiring veteran lawyers, smaller organizations are building systems and processes that can help them keep the spiralling costs in check. Apart from the exorbitant fees, complicated judicial process also makes it less accessible to ordinary citizens and smaller companies. Not everybody can afford to go through the process because the process is itself a punishing one. For a cash-strapped start-up, it becomes nearly unviable to go against a larger institution given the fact that the course of the litigation itself will drain all their financial resources with zero guarantee of a favourable judgement. The 240th Report of the Law Commission states: “A litigant, who starts the litigation, after some time, being unable to bear the delay and mounting costs, gives up and surrenders to the other side or agrees to settlement which is something akin to creditor who is not able to recover the debt, writing off the debt. This happens when the costs keep mounting and he realises that even if he succeeds, he will not recover the actual costs. Moreover, external recourse funding in the form of loans often come at high interest rates and thus, act as catalysts to the financial nightmare of litigation.

The quest for justice is undoubtedly an expensive one. But is there a way out?

The

concept of litigation expenses has been existing for decades now in the western

parts of the world. However, it is still at its nascent stage in India. LegalPay

offers non-recourse funding to litigants who do have a strong case but lack the

financial means to pursue it in order to get a settlement. Litigation funding

creates a win-win situation by generating high returns from a cut of that settlement

amount for the investors and by allowing the litigant to pursue the case at

zero cost and zero risk. Due to the funding being non-recourse in nature, the

litigant shall not be required to pay LegalPay

anything in case the judgement is not in their favour. Even if the experienced

professionals at LegalPay review the case using data-driven analytical tools and

decide not to fund it, it would be indicative of the odds being stacked against

them. in the case. 90% of applicants who LegalPay did not fund, decided not to

pursue the case as it failed the preliminary test of meritocracy, thereby

saving significant money which would otherwise have been spent on legal fees.

Shifting

the burden of a litigation to a third-party funder is not just a powerful tool

for risk mitigation, but would also play an instrumental role in contributing

to the nation’s GDP by allowing growth-oriented businesses to utilize their

resources in expanding operations and innovating instead of getting them locked

up in a legal case.

Comments

Post a Comment